Private mortgage lending has exploded by 23% across BC and Alberta in 2025, and smart homeowners are discovering why this alternative financing route is solving problems that traditional banks simply can't handle anymore.

If you're dealing with complex income situations, tight timelines, or credit challenges, private lending might be the solution you didn't know existed. Here's everything you need to know about how private mortgages are changing the game for Surrey and Alberta homeowners in 2026.

What Exactly Is Private Mortgage Lending?

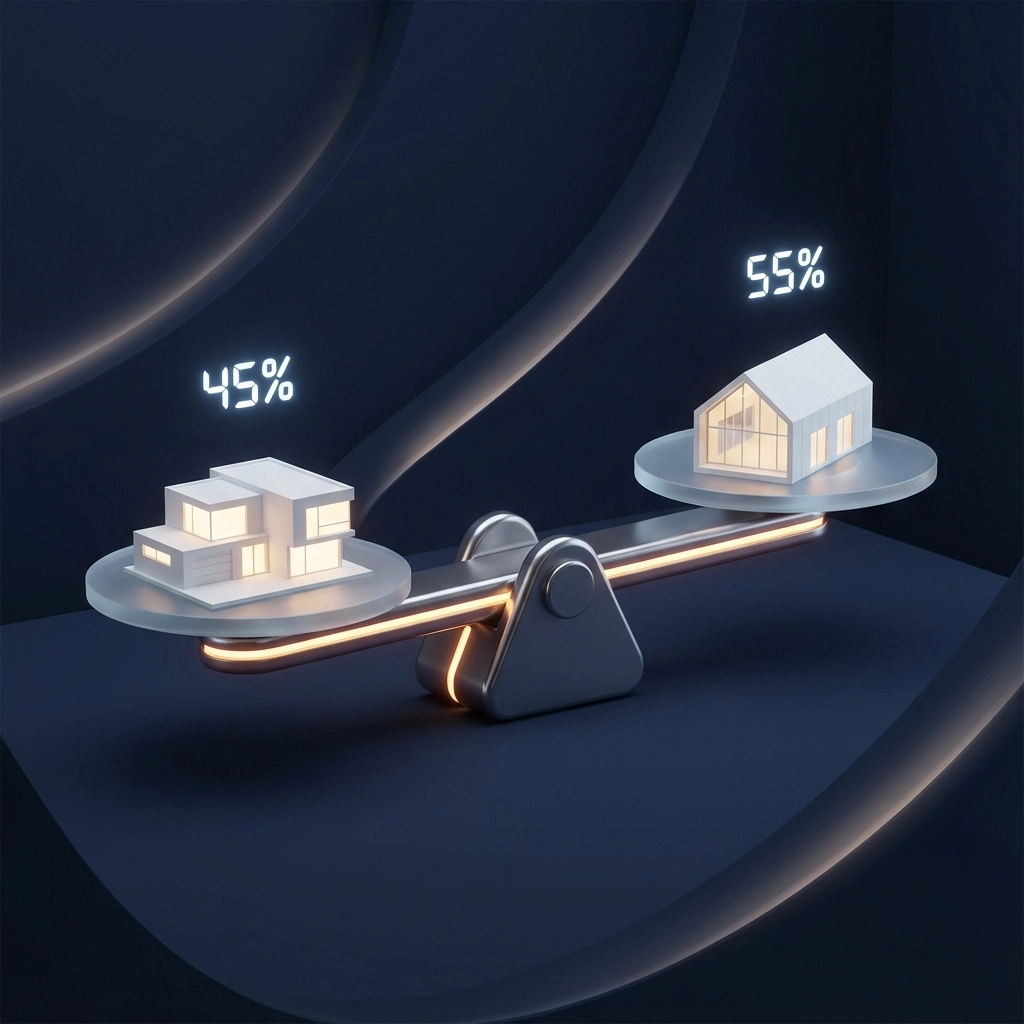

Private mortgage lending is short-term financing (typically 6-24 months) provided by individual investors or private companies instead of traditional banks. These lenders focus on your property's value and equity rather than your credit score or employment history.

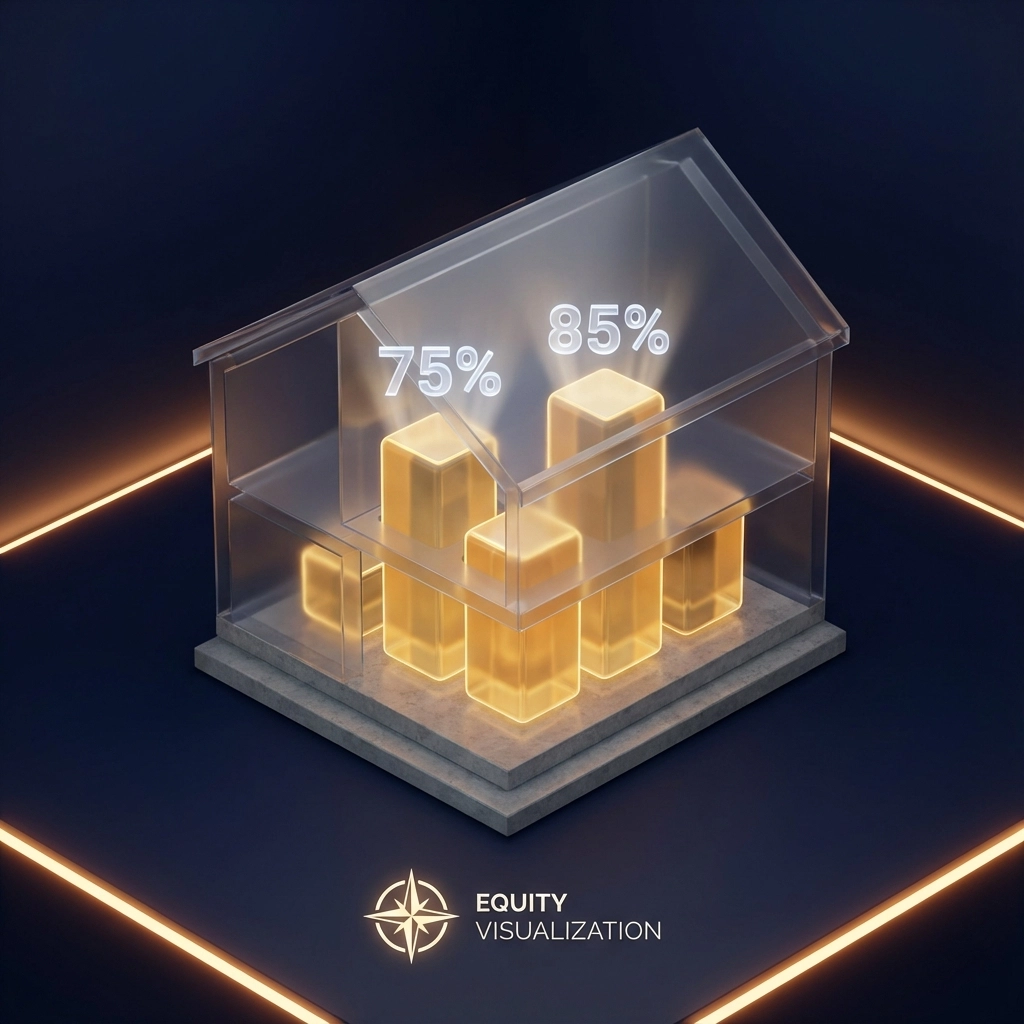

Think of it as asset-based lending. If your Surrey townhouse is worth $800,000 and you owe $400,000, you have $400,000 in equity. Private lenders will typically loan up to 75-85% of your property value, meaning you could access up to $240,000-$280,000 in financing.

The key difference? Banks say "no" based on your income verification or credit history. Private lenders say "yes" based on your property's value and your exit strategy.

When Private Lending Makes Perfect Sense

Fast-Track Approvals (24-72 Hours)

You're competing for that perfect Surrey investment property, but your bank wants 30-45 days for approval. Private lenders can approve and fund in as little as 3-5 business days. In today's competitive market, that speed advantage is everything.

Self-Employed Income Challenges

If you're a contractor, real estate agent, or business owner in Alberta, you know the frustration of bank income verification. Private lenders don't care about your T4 slips or CRA assessments, they care about your property equity and repayment plan.

Bridge Financing Solutions

You found your dream home in Burnaby, but your current Surrey property hasn't sold yet. Private lending bridges that gap, letting you close on the new purchase while avoiding the stress of conditional sales or lost opportunities.

Construction Holdbacks and Development Projects

Alberta developers know this pain: traditional lenders hold back 10-15% of construction funds until project completion. Private lenders often release these holdbacks faster, improving your cash flow during critical build phases.

Surrey's Private Lending Market in 2026

Surrey's real estate market continues to attract both local and international investors, creating a robust private lending ecosystem. Current private mortgage rates in Surrey range from 8.5% to 12% annually, depending on:

- Loan-to-value ratio (lower LTV = better rates)

- Property type and condition

- Borrower experience and exit strategy

- Term length and complexity

Popular Surrey Private Lending Scenarios:

- Fix-and-flip projects: Investors buying older Surrey homes for renovation

- New immigration financing: Recent immigrants with substantial down payments but limited Canadian credit history

- Rental property acquisitions: Experienced landlords expanding their portfolios quickly

- Divorce settlements: Quick access to equity for property buyouts

Alberta's Private Lending Landscape

Alberta's economic diversification has created unique private lending opportunities, especially in Calgary and Edmonton. Oil and gas professionals often have high net worth but variable income, making private lending an attractive option.

Alberta-Specific Advantages:

- Lower property values mean smaller loan amounts and reduced risk

- Strong rental markets support investment property strategies

- Energy sector professionals understand asset-based lending concepts

- Rural and acreage properties that banks won't touch

Private mortgage rates in Alberta typically run 0.5-1% lower than BC due to lower property values and different risk profiles. Expect rates between 8% and 11% for most scenarios.

Private vs. Bank vs. B-Lender Lending: The Real Comparison

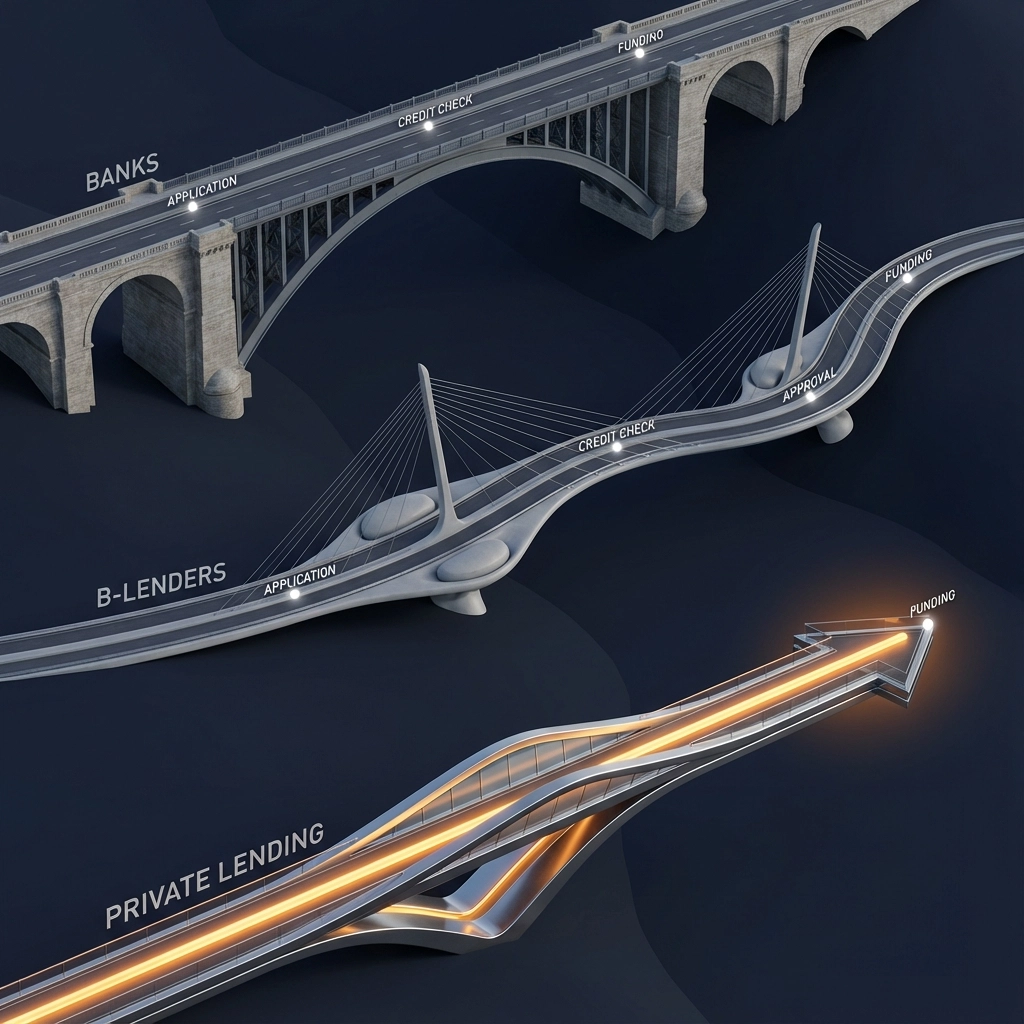

Bank Mortgages:

- Rates: 5.5-7% (2026 rates)

- Approval time: 30-45 days

- Income verification: Strict

- Credit requirements: 650+ score typically required

- Property restrictions: Conservative appraisals, limited property types

B-Lender Mortgages:

- Rates: 7-9%

- Approval time: 10-15 days

- Income verification: Moderate flexibility

- Credit requirements: 580+ score acceptable

- Property restrictions: Some flexibility

Private Mortgages:

- Rates: 8.5-12%

- Approval time: 3-5 days

- Income verification: Property equity focused

- Credit requirements: Secondary consideration

- Property restrictions: Maximum flexibility

Yes, private lending costs more. But consider this: if that extra 3-4% in interest helps you secure a property that appreciates 10-15% annually, or generates rental income that covers the payments, the math works in your favor.

Real Client Success Stories

Surrey Investor Case Study:

Last month, a client found a Surrey duplex listed at $1.2 million with immediate possession available. His bank approval would take 6 weeks, but the seller needed 10 days. We arranged private financing at 9.5% for 12 months. The property now generates $4,800 monthly rental income, and he's refinancing to conventional lending next month. Total cost of private lending: $15,000. Value gained by acting quickly: $180,000+ based on comparable sales.

Calgary Business Owner Example:

An Alberta contractor needed $300,000 to purchase equipment for a major infrastructure project but couldn't show traditional employment income. His Calgary home provided sufficient equity for private financing at 10%. The equipment purchase led to a $2.4 million contract. The 10% interest rate became irrelevant compared to the business opportunity it enabled.

Burnaby Bridge Loan Success:

A growing family needed to move from their Burnaby condo to a larger home before their current property sold. Private lending provided the $650,000 bridge loan at 11% for 6 months. They avoided rental costs, kept their children in the same schools, and sold their condo 4 months later for $50,000 above their expected price.

Understanding the Risks

Private lending isn't risk-free, and honest mortgage brokers will explain the potential downsides:

Interest Rate Risk: Private rates are higher than bank rates. If your exit strategy fails, carrying costs can become expensive.

Renewal Risk: Most private mortgages have 6-24 month terms. You need a clear plan for renewal or refinancing before the term expires.

Property Risk: Private lenders may require faster sales or refinancing if property values decline significantly.

Due Diligence Risk: Some private lenders have less regulated processes than banks. Working with experienced mortgage brokers helps you avoid predatory lenders.

The Private Lending Process: What to Expect

Day 1-2: Property appraisal and document collection

Day 3: Lender review and conditional approval

Day 4-5: Legal documentation and funding

Total timeline: 5-7 business days for most scenarios

Documents You'll Need:

- Property tax assessments

- Recent property appraisal (if available)

- Basic income verification (less strict than banks)

- Photo ID and basic credit check

- Clear exit strategy explanation

2026 Market Trends Affecting Private Lending

Regulatory Changes: New federal mortgage rules are making bank qualifying even stricter, driving more borrowers toward private options.

Interest Rate Environment: With Bank of Canada rates stabilizing around 4.5-5%, the spread between bank and private lending has narrowed, making private options more attractive.

Foreign Buyer Impact: Reduced foreign investment has created more opportunities for local investors using private financing.

Construction Industry Changes: New building codes and municipal requirements are creating more complex financing needs that private lenders handle better than traditional institutions.

Choosing the Right Private Lender

Not all private lenders are created equal. Here's what separates the professionals from the problematic:

Look for lenders who:

- Provide clear, written terms upfront

- Have established track records (3+ years minimum)

- Offer competitive rates within market ranges

- Maintain proper legal documentation

- Work with experienced legal counsel

- Provide references from previous clients

Avoid lenders who:

- Require large upfront fees before approval

- Offer rates significantly below market (likely predatory)

- Rush you into signing without proper legal review

- Have no verifiable business address or history

- Make unrealistic promises about approval timelines

Making Private Lending Work for Your Situation

The key to successful private lending is having a clear exit strategy from day one. Ask yourself:

- Refinance Strategy: Can you qualify for conventional financing within 12-18 months?

- Sale Strategy: Is the property marketable if you need to sell quickly?

- Income Strategy: Will the property or project generate enough income to cover carrying costs?

- Timeline Strategy: Do you have realistic timelines for your exit plan?

Your Next Steps: Getting Started with Private Lending

If private lending sounds like the solution for your situation, here's your action plan:

Step 1: Get your property appraised to understand your available equity

Step 2: Calculate your project costs and timeline requirements

Step 3: Research your exit strategy options (refinancing, sale, or project completion)

Step 4: Connect with an experienced mortgage broker who specializes in private lending

Remember: private lending is a tool, not a destination. The most successful clients use private financing to access opportunities that traditional lending couldn't provide, then transition back to conventional financing when possible.

Whether you're a Surrey investor looking to expand your portfolio, an Alberta business owner needing flexible financing, or a homeowner dealing with unique circumstances, private lending might be the solution that unlocks your next opportunity.

Ready to explore your private lending options? Contact our team for a confidential assessment of your situation. We'll review your property equity, discuss your goals, and connect you with vetted private lenders who specialize in your specific needs.

Call us today at our contact page to discuss how private lending can work for your unique situation. Time-sensitive opportunities won't wait for traditional bank timelines: but with the right private lending strategy, you don't have to miss them either.

About Varun Chaudhry

Licensed mortgage broker with over 18 years of experience in the Canadian mortgage industry. Specializing in MLI Select, construction financing, and self-employed mortgages across BC, AB, and ON.